1.9.26: Getting back to first principles

a half-assed investing framework

It’s 2026. Feels wild to type that. Hope everyone had a good and somewhat restful break. Although I saw this meme and man it really hit…

No childcare for 2 weeks is not for the faint of heart. In all seriousness though, It was grounding to slow down a bit, spend time with family, and just take a beat in a world that seems to be accelerating more rapidly every day. A reminder to do more of that in 2026 where I can.

I’m not a big resolutions gal. I’m more of the continuous improvement type. But, at the close of one year, I can’t help but reflect as I embark on the next. So as it relates to this newsletter, two things I want to do more of: write (so hopefully more weekly musings, not less) and giving myself more flexibility and grace to do what feels right and being thoughtful about the why behind it.

Which brings me to investing…

2025 Reflection

Looking back at my 2025 investments, I realized a somewhat uncomfortable truth. I was quite market-driven in that I had a thesis and the company fit that, but often at the expense of other considerations. I don’t think I was nearly framework-driven enough.

I chased weird and wonderful markets and that served me well. But often, I might have been moving faster than my own first principles. Decisions were more reactive than reflective and that’s not really how I want to invest longer term. The market may be crazy, but me as an investor doesn’t have to be :-)

So I spent time and sat with a deceptively simple question: what do I actually want my investments to embody in 2026? The only thing I can really control is my decision to make the investment, so what does the arc of that look like? This is my attempt to answer/work through that.

Back to where it started: The OpenView One-Pager

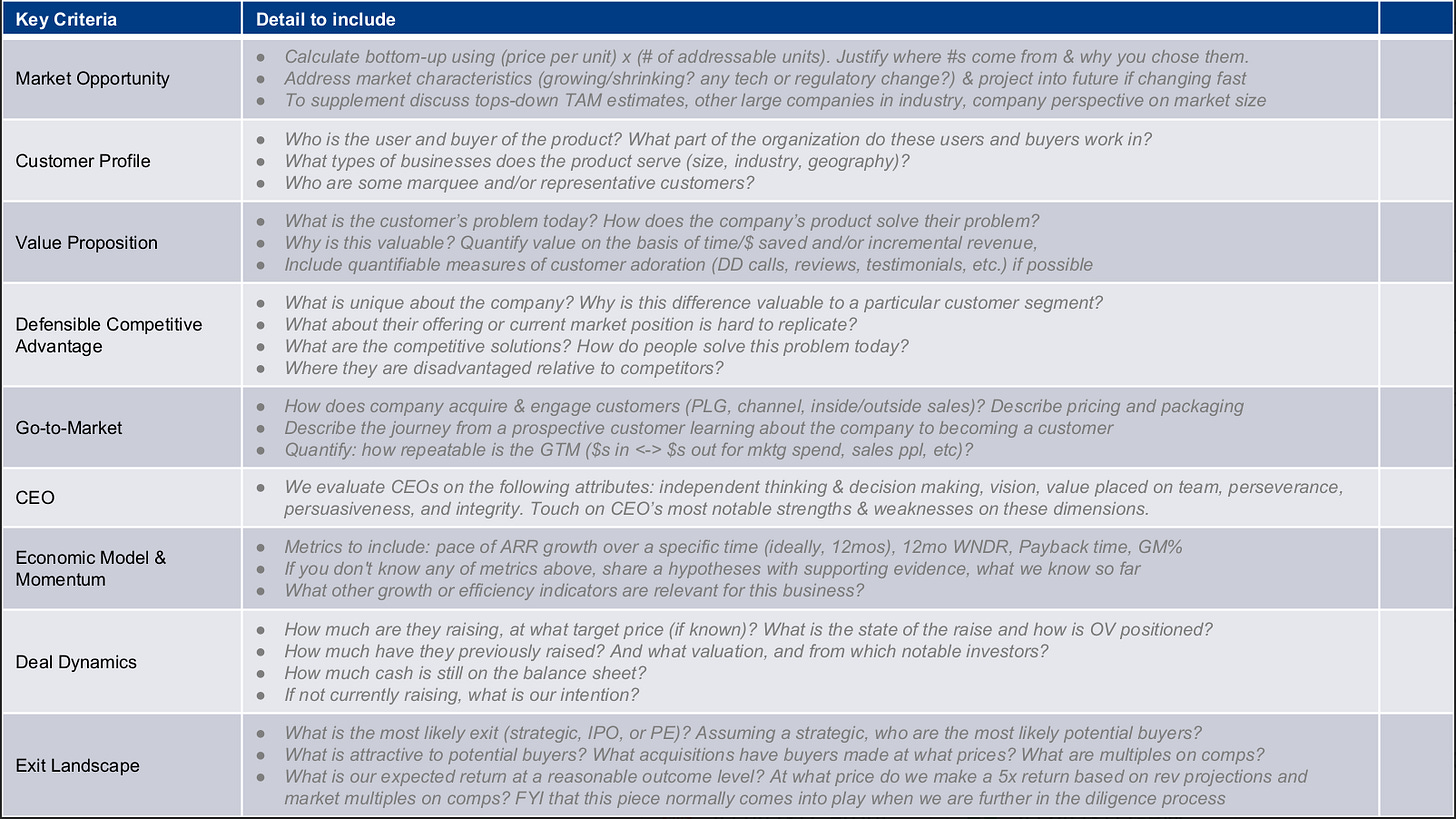

I first learned how to do venture at OpenView (RIP). The training was phenomenal and also incredibly painful. We would have to write these long, exhaustive investment memos for investments we were never actually going to do - it took hours, multiple drafts, and honestly quite a few tears were shed. At the beginning of each of these memos was a concise one-pager that broke down all of the work you did into a single sheet of paper for the IC to grok the opportunity. No fluff- just a structured breakdown of the business. I went through my archives and found it. Now granted, OV was later stage and this is very much of its time (circa I think ~2018), but the framework still holds up surprisingly well…

Sure, it’s formulaic and almost rigid, but I do think there is real value in being forced to explain a business simply and coherently on a single sheet of paper. The gaps showed themselves REAL quick. So rather than reinventing the wheel, I decided to start here.

What follows is an attempt to adapt the framework- knowing what I know now doing early stage and just being a part of such an ever evolving market. Same underlying questions, I think a bit different weighting. Mostly the same structure, but sharper filters too.

Founder First, Always

Before anything else: I am deeply unapologetically founder-driven and so much of it is about the intangibles. I have to be honest about that and lead with this in my criteria. Everything below matters, but it only matters if I believe in the founder. This framework exists to sharpen conviction NOT to replace it.

The 2026 Adapted CBR One-Pager

Market Opportunity: I never really worry about TAM. I think great founders make/expand markets, but the questions that matter to me are:

Is the market meaningfully large and is it growing or not? No need to over analyze but rough strokes.

Why hasn’t this been done well before? If it has been done well before, what is the unlock for this business that will make it orders of magnitude better?

Is this something the big foundational model labs will inevitably do or can it truly stand alone (orthogonal enough or just different domain?)

It’s just about being intellectually honest on timing and market landscape.

Customer Profile:

Who is the customer actually?

How acute is the pain? Is it aspirin or vitamin?

Will they truly be willing to pay to solve it AND where will the budget come from?

I need to believe there is urgency and willingness to pay to solve this problem. PMF means finding true pull, not having to push and very few businesses have that, but so much of it is whether the solution fits the customer profile and how much of a pain it can solve.

Value Proposition:

Meh, feels like I sort of collapsed this and the one above. It’s all about mission critical. Are you saving time, money, labor… and how critical are those savings?

Defensible Competitive Advantage: I always HATED this one back in the day. I feel like defensibility is way harder than anyone likes to admit. AI only makes it more extreme. So instead of squinting at abstract moats…

What is genuinely hard to replicate here if anything?

Is there a real special sauce (technical, data, workflow, distribution)?

How competitive is the market today? Has a king already been crowned? I do think this is more of a consideration today given how capital is being allocated.

If so, how does this company/founder plan to compete? Product? GTM? Distribution advantage?

I’ve made the mistake of going into crowded markets without a clear answer here. You have to figure out how you are going to win if you are competing against a sea of very well-funded competitors. If the founder doesn’t see the path, then I certainly shouldn’t either (pre-investment).

GTM

What’s the plan to reach customers? With outbound becoming less effective, any creative ideas on GTM?

Does founder have a sense of how they will make money? I love this phrase can he/she “smell money”? And are they commercial enough to sell the first $1-2M?

Ultimately, the question here is what’s the plan to really sell this thing, to scale it quickly, and can the CEO do that?

CEO

Are they inevitable? I stole this from Carmen and Cocoa VC. The idea is that the founders just have an inevitability to them that they will make something happen or die trying. Can also think about this as grit.

Unfair insight? I think this may be one that I under-indexed on historically. I think especially in today’s world where creating software is easier than ever, there has to become unfair insight for a founder to start and build the business. What’s a secret that only they know?

AI-native? I was slow to the punch on this one, but it really does matter now more than ever both in recruiting and adapting the ever changing world.

Can/will they scale?

One of the things i’ve found over time is that every founders greatest strength is in some way also their greatest weakness (two sides of same coin) so really taking a more critical/objective approach to understanding the founder is important. I’d argue more important than any other category above.

Economic Model & Momentum

This one matters so much less in early stage as most businesses we invest in are pre revenue, but it is helpful to get a sense of how the founder thinks about charging and pricing, but much less relevant imo.

[Leaving off deal dynamics and exit landscape]

This loose framework isn’t meant to be prescriptive or dogmatic. More a snapshot or a reminder to myself to think about what matters and start with first principles vs. getting swept up in the “deal”. Frameworks constantly evolve, markets shift, and so will my thinking, but in just writing this out it felt grounding in a time of great noise.

So with that, here’s to investing with more intention, with conviction, and hopefully a little more thoughtfulness and patience in 2026.

And with that, a tune to close it out…

Stay weird. Stay curious.

-CBR